Easy steps to download Pan card Online | How to download Pan Card online in 2024? We’ll explain how to download your PAN Card online in this post. In India, PAN cards are issued by three government-affiliated agencies. At this point, your PAN card is being created by whichever company it is made by.

To download your PAN card, visit the website of the same Income Tax Pan service unit. On its website, you can obtain a digital copy of your PAN card that you can carry about. It is a legitimate government document that can be used to make any kind of purchase, including bank transactions.

Until ninety days after the PAN card is issued, all Income Tax Pan service unit portals offer free PAN card downloads. After that, via an online payment method like UPI, Net Banking, or a mobile device, the service costs Rs. 8.26. Paying with a bank card is possible.

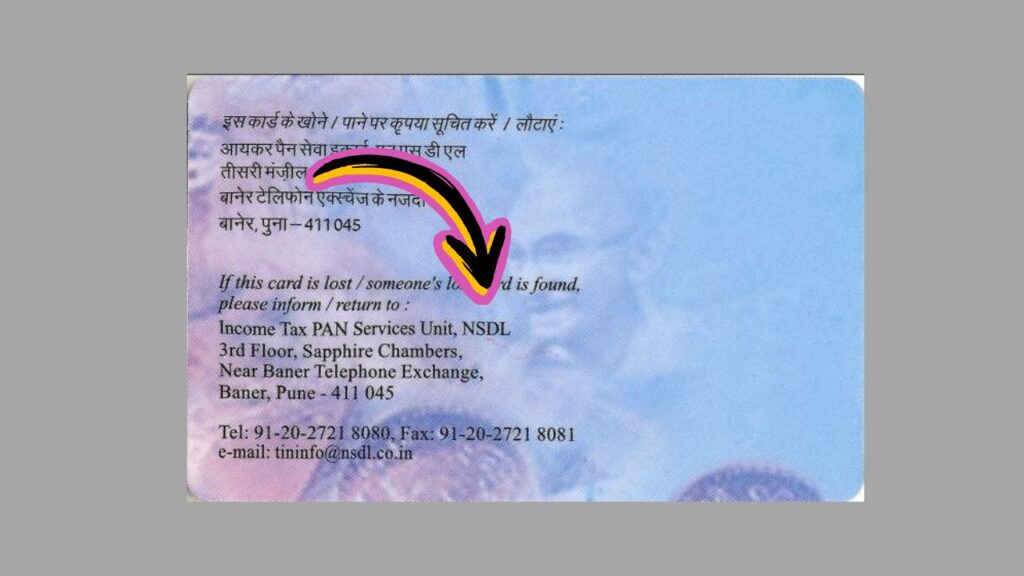

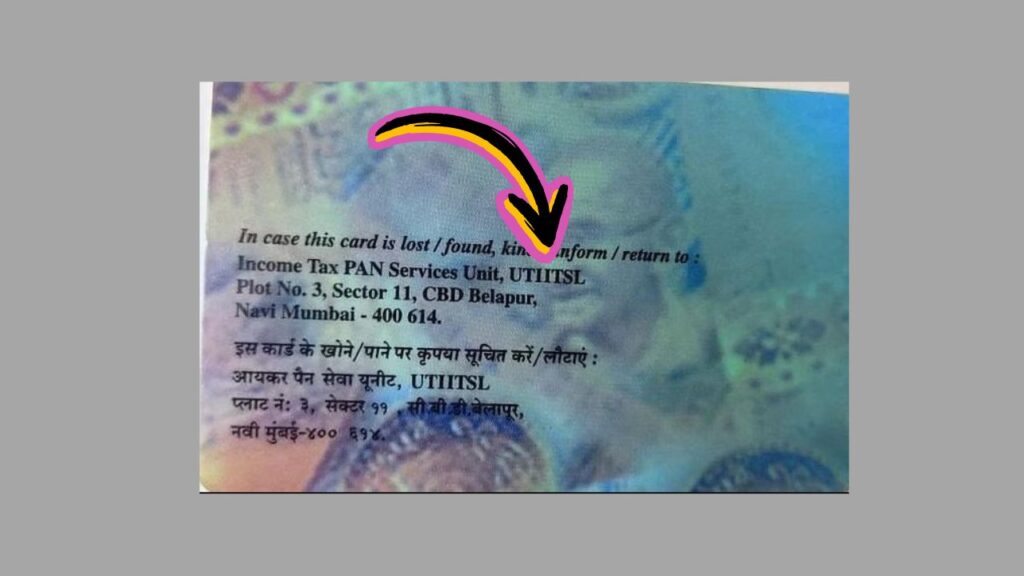

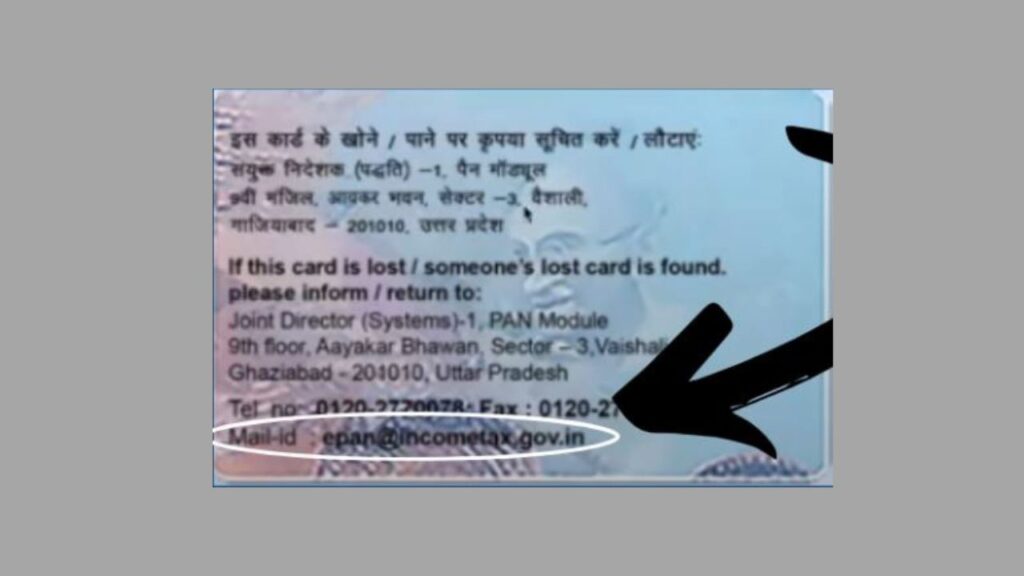

Now, if you have a new PAN card and you have no idea which Income Tax Pan service unit issued it, the name of the Income Tax Pan service unit will be listed on the slip that is issued when you apply online. In addition, if your PAN card has been issued, you can discover the name of the issuing business on the back of the card.

For instance, I’ve included a download link and copies of a few PANs here.

NSDL PAN

UTI PAN

Income Tax Portal

Overview:

| Name of Title | PAN Card |

| Name of Post | PAN Card Download New Process |

| NSDL PAN Download | Click here |

| UTIITSL PAN Download | Click here |

| Income Tax PAN/ E-PAN Download | Click here |

| NSDL PAN Status | Click here |

| UTIITSL PAN Status | Click here |

| Official Website | Click here |

How to Apply Pan Card Online in 2024:

So far, three companies have been identified as offering the PAN card download service. This time, we’ll look at the PAN card creation procedure. Companion, Form 49A is duly completed for Indians in order to create a new PAN card.

Generate Token Number

- Click on the given link click here

- Click on New PAN – Indian Citizen (Form 49A) in Application Type.

- Click on INDIVIDUAL in Category

- Select your title (Shri/Mrs./Kumari)

- Enter your name (First+Middle+Last)

- Enter your date of birth.

- Enter E-Mail ID.

- Enter your mobile number.

- Enter the captcha code and click on the proceed option.

Step 1: Personal Detail

- Click on Submit Scanned Images through e-sign.

- If you want physical PAN card then click on Yes option.

- Enter the last four digits of your Aadhar card.

- Enter your name (as per Aadhaar card)

- Enter your father’s name and mother’s name (optional).

- Mother or father should choose whose name they want to appear on their PAN card and proceed.

Step 2: Contact & Other Detail

- Choose your source of income in this.

- Select your address type (Office/ Residence)

- Enter your flat/room/door/block number

- Name of your building/village/locality

- Enter the name of the post office/ street/ road.

- Enter the name of the area/taluka/tehsil/sub-division.

- Enter the name of town/city/district.

- Enter the name of your state and country and proceed.

Step 3: AO Code

- Enter your Area Code, AO Type, Range Code, AO Number in it.

- If you do not know this code then you can check it by going to the search option.

Step 4: Document Detail

- In this you have to select all your enclosures like- Identity/Address/Date of Birth

- Keep in mind that whatever enclosure you choose above, you will have to upload it also.

- In the declaration you have to enter your full name and choose the option of Himself/Herself.

- Enter the name of your district in place of Place.

- You have to upload your passport size photo and signature.

- Upload PDF copies of all your enclosures and click on Submit option.

After completing these four steps, we also have to deposit the fee. You can pay this fee both online and offline. For this only a fee of Rs 107 has to be paid.

How to check New PAN Card Status?

As we know that we can make PAN cards from three companies, similarly we can download them in three ways. Here we will see how to check the status of New PAN Card. Friends, let us tell you that here we can see the status of PAN card in three ways.

Click to see NSDL PAN Card Status click here

Click to see UTIITSL PAN Card Status click here

Click to see Income Tax PAN Card Status click here

FAQs:

- How to make a new PAN card?

- Can PAN card be made without CSC ID?

- What is the difference between PAN card issued by NSDL, UTIITSL and INCOME TAX?

- What is the identity of NSDL PAN card?

- What is the identity of UTIITSL PAN card?

- What is the identity of PAN card issued by Income Tax Department?

- How to check PAN Card status?

- What things can be amended in PAN Card?